Smart Weapons Market Growth Drivers, Demand and Opportunities by 2028

The global smart weapons market was valued at $17.17 billion in 2020. Over the next several years, the market is projected to experience significant growth, reaching an estimated $30.12 billion by 2028. This represents a compound annual growth rate (CAGR) of 8.02% during the 2021-2028 period.

Despite the short-term setback, the long-term outlook for the smart weapons market remains quite positive. Factors driving this growth include continued military modernization efforts, the need to address evolving security threats, and ongoing technological advancements in areas like guidance systems and autonomous capabilities. As nations work to maintain their strategic advantages, the demand for increasingly sophisticated smart weapons is expected to rise steadily in the coming years.

Informational Source:

https://www.fortunebusinessinsights.com/smart-weapons-market-104058

In the ever-evolving landscape of military technology, the emergence of smart weapons has revolutionized the way modern warfare is conducted. These advanced, precision-guided munitions have become a game-changer, offering unparalleled accuracy, increased lethality, and enhanced protection for both military personnel and civilian populations.

The Smart Weapon Ecosystem: Key Components and Capabilities

At the heart of the smart weapon ecosystem are several critical components that work in seamless harmony to deliver remarkable capabilities. These include:

Guidance and Navigation Systems: Cutting-edge guidance systems, such as laser-guided, GPS-aided, and infrared-homing technologies, enable smart weapons to precisely navigate and home in on their intended targets. These systems leverage sophisticated algorithms and sensor arrays to track and lock onto targets with remarkable precision, reducing collateral damage and increasing the probability of a successful strike.

Propulsion and Aerodynamics: Advancements in propulsion systems, such as solid-fuel rocket motors and turbine engines, provide smart weapons with the speed and maneuverability to reach their targets rapidly and effectively. Similarly, innovative aerodynamic designs, including stealth features and control surfaces, enhance the weapon's in-flight stability and evasion capabilities, making them less vulnerable to countermeasures.

Warhead and Explosive Technologies: Smart weapons often incorporate advanced warhead and explosive technologies, such as programmable fuzes, fragmentation patterns, and variable yields. These features enable the weapon to adapt its destructive power based on the target, minimizing collateral damage and maximizing the desired effect.

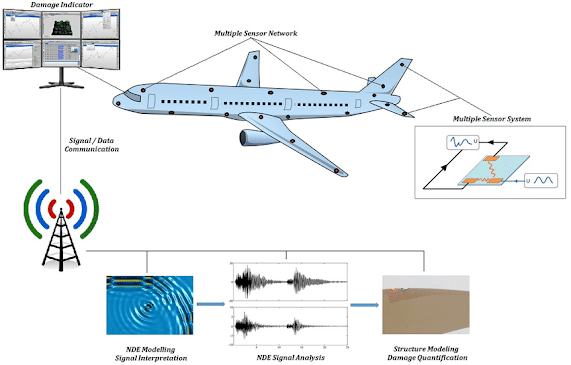

Networked Command and Control: Smart weapons are increasingly integrated into networked command and control systems, allowing for real-time targeting data, in-flight updates, and coordinated strikes across multiple platforms. This integration enhances the overall situational awareness and decision-making capabilities of military forces, enabling them to respond more effectively to evolving tactical scenarios.

Some of the leading players in the global smart weapon market include:

- BAE Systems (The U.K)

- Boeing (The U.S.)

- General Dynamics Corporation (The U.S.)

- Lockheed Martin Corporation (The U.S.)

- MBDA (France)

- Northrop Grumman Corporation (The U.S.)

- Raytheon Company, a Raytheon Technologies company (The U.S.)

- Rheinmetall AG (Germany)

- Textron Inc. (The U.S.)

- Thales Group (France)

The Evolution of Smart Weapons: From Precision to Autonomy

The development of smart weapons has undergone a remarkable transformation, progressing from simple precision-guided munitions to increasingly autonomous and intelligent systems.

Precision-Guided Munitions: The first generation of smart weapons focused on improving the accuracy and reliability of guided munitions. These weapons, such as laser-guided bombs and GPS-guided missiles, significantly reduced the risk of missed targets and collateral damage compared to unguided ordnance.

Sensor-Fuzed Weapons: Building upon the precision-guided concept, sensor-fuzed weapons incorporate multiple submunitions or bomblets, each equipped with advanced sensors and explosives. These weapons can detect, identify, and engage multiple targets within a designated area, enhancing the overall effectiveness of the strike.

Loitering Munitions: Also known as "suicide drones," loitering munitions are a unique class of smart weapons that combine the capabilities of an unmanned aerial vehicle (UAV) and a guided missile. These systems can loiter over an area of interest, detect and identify targets, and then execute a precision strike by crashing into the target.

Autonomous and Semiautonomous Systems: The latest evolution in smart weapons is the integration of autonomous and semiautonomous capabilities. These systems use advanced sensors, artificial intelligence, and machine learning algorithms to detect, track, and engage targets without direct human intervention. While still under the supervision of human operators, these autonomous systems can dramatically increase the speed and precision of targeting, reducing the cognitive burden on military personnel.

The Global Smart Weapon Market: Drivers and Trends

The global smart weapon market has experienced significant growth in recent years, driven by several key factors:

Asymmetric Threats and Evolving Warfare: The proliferation of non-state actors, terrorist groups, and the increasing use of unconventional warfare tactics have fueled the demand for smart weapons. These precise and adaptable systems are better equipped to counter the challenges posed by asymmetric threats, improving the overall effectiveness of military operations.

Technological Advancements: Rapid progress in areas such as guidance and navigation systems, propulsion technologies, and artificial intelligence has enabled the development of increasingly sophisticated smart weapons. These advancements have led to improved accuracy, range, and autonomous capabilities, enhancing the overall effectiveness and value proposition of these systems.

Increased Defense Spending and Modernization Initiatives: Governments around the world are investing heavily in military modernization programs, with a particular focus on enhancing their arsenal of smart weapons. This trend is driven by the recognition of the strategic advantages offered by these precision-guided munitions in both conventional and unconventional warfare scenarios.

Demand for Reduced Collateral Damage: The growing emphasis on minimizing civilian casualties and property damage has led to a greater demand for smart weapons. These systems, with their advanced targeting and guidance capabilities, can help reduce the risk of unintended harm, making them more appealing to military and political decision-makers.

Emergence of Unmanned Systems: The rise of unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and other autonomous platforms has further fueled the development of smart weapons. These integrated systems leverage the strengths of both the weapon and the platform, enabling more precise and effective engagements.

Smart Weapon Market Segmentation and Key Players

The global smart weapon market can be segmented based on various factors, including:

Weapon Type: This includes guided bombs and missiles, sensor-fuzed weapons, loitering munitions, and autonomous/semiautonomous systems.

Guidance and Navigation Systems: Laser-guided, GPS-guided, infrared-homing, and other advanced guidance technologies.

Platform: Air-launched, surface-launched, and subsurface-launched smart weapons.

End-User: Military, defense, and homeland security applications.

Regional Dynamics and Market Outlook

The global smart weapon market exhibits varying levels of growth and adoption across different regions:

North America: The United States is the dominant player in the North American smart weapon market, driven by its significant defense spending and the presence of major defense contractors. The region's focus on military modernization and the growing threat of asymmetric warfare have fueled the demand for advanced smart weapon systems.

Europe: Countries in Europe, such as the United Kingdom, France, and Germany, are also major contributors to the smart weapon market. The region's emphasis on maintaining a strong defense posture and the need to address emerging security challenges have led to increased investment in smart weapon technologies.

Asia-Pacific: Emerging economies, such as China, India, and South Korea, are experiencing a rapid expansion in their smart weapon capabilities. This growth is driven by the need to modernize their military forces, address regional security concerns, and maintain a strategic edge over potential adversaries.

Middle East and Africa: The Middle East region, in particular, has seen a surge in demand for smart weapons due to ongoing conflicts and the need for precision-guided munitions. Countries in this region are actively investing in these technologies to enhance their military capabilities and counter various security threats.

Latin America: While the smart weapon market in Latin America is relatively smaller compared to other regions, countries like Brazil and Chile are increasingly exploring the acquisition of these advanced systems to modernize their armed forces and address regional security challenges.

Looking ahead, the global smart weapon market is poised for continued growth, driven by the relentless pursuit of military technological superiority, the need to address evolving security threats, and the ongoing advancements in guidance, navigation, and autonomous capabilities. As nations strive to maintain their strategic advantages, the demand for smart weapons is expected to rise, further shaping the future of modern warfare.

Comments

Post a Comment